Retail’s not dying. Not at all. Some retailers are, but that’s because this sector is evolving and leaving behind the companies that don’t evolve with it.

Yet, plenty still think that retail’s not doing so hot.

That’s why they missed out on this giant opportunity...

We’re talking about Macy’s, here. Not super exciting, right? It’s no Tesla.

Like my Apple trade, not many would expect such massive moves on this boring stock.

However, an SDF triggered when I noticed that Macy’s was one of the most traded stocks in the market on August 17th. Someone bought 105,816 contracts worth about $4.6 million in total.

Someone out there believed Macy’s would do well in the short term… but also over the next few months.

I also used events at the macro-level to confirm this could be a good move — this was a reopening play. Remember: one indicator alone isn’t always enough. You should check out other factors as well.

Of course, we weren’t going to buy shares. If Macy’s had a bright future, we wanted to go with options to squeeze out every drop of profit potential...

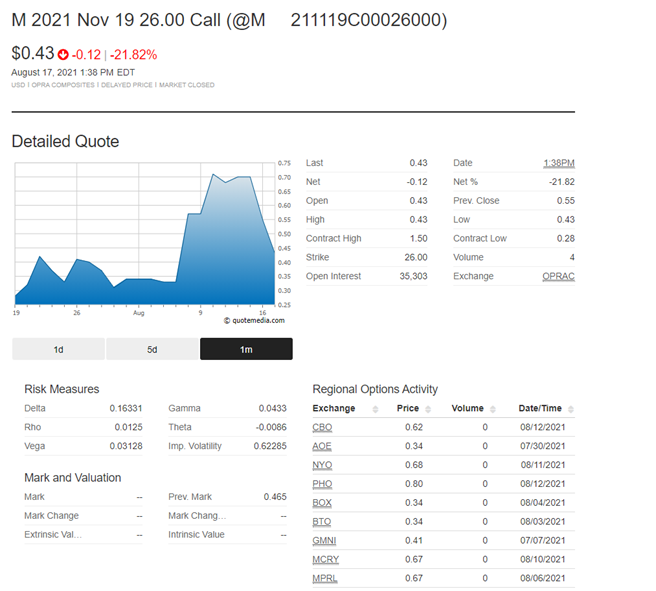

So we bought this call option:

M 2021 Nov 19 26.00 Call

And we made sure not to pay more than $0.50/contract. We were aiming for $0.40, but anything in that range could work.

We’ve only got one tranche on this one: Sell all contracts at a 452% gain.

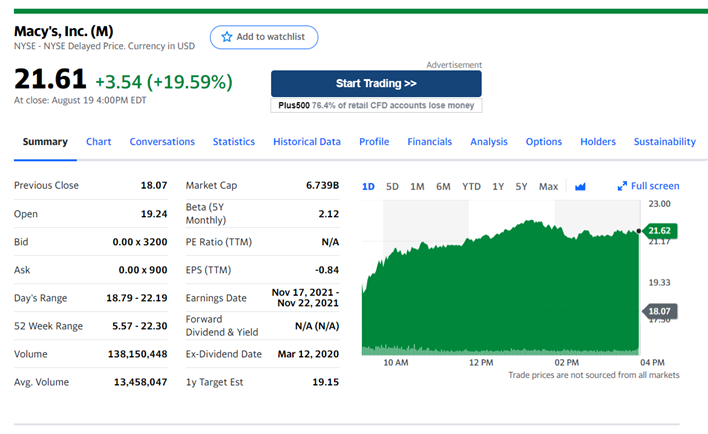

Macy’s stock price closed at $18.07/share the day we set up our position, a small drop from the market opening…

Then moved up a couple dollars to close at $21.61/share, pushing our position up 180% overnight!

Yes, they had strong earnings on that day. But I wasn’t in this position for earnings. They certainly helped with those initial gains, but I’m looking longer-term at Macy’s.

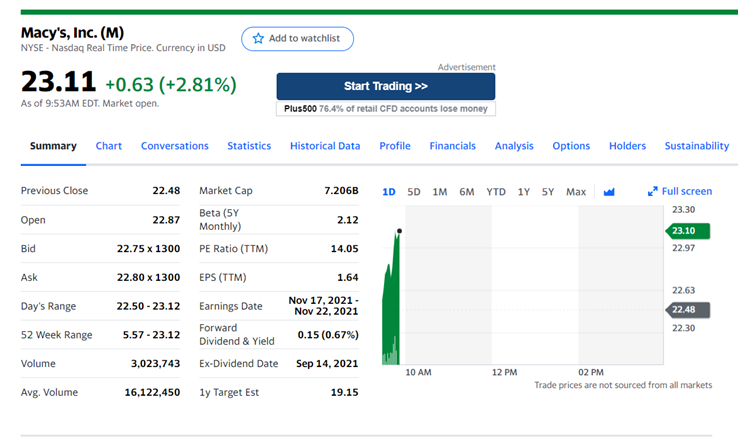

Macy’s continued climbing over the next few days, reaching $22.39 at market close on August 20th.

Come Monday, August 23rd’s, Macy’s just kept going.

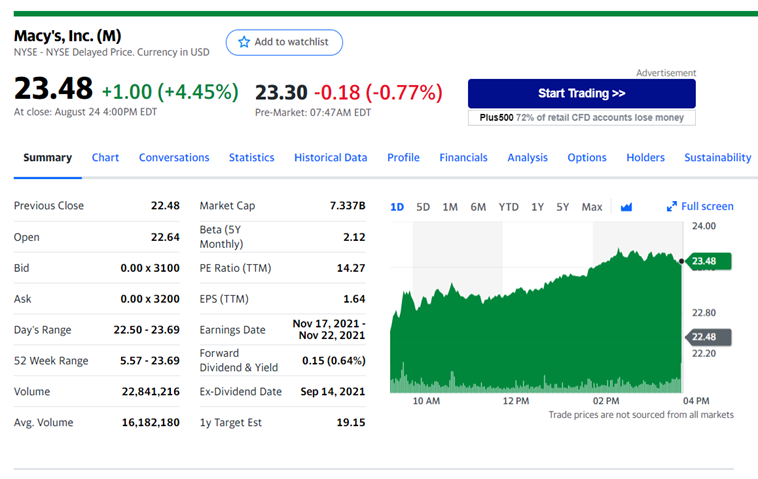

The momentum continued. Macy’s reached $23.48/share when the market closed on August 24th.

Overall, we scored 200% gains in under ten days. At this rate, we could hit our target pretty soon.

This goes to show you that boring stocks no one’s paying any attention to can sometimes offer the best opportunities.

In fact, I find these types of trades fairly regularly. While everyone chases the next fad, I’m enjoying triple-digit gains on whales like this one...

Head here to learn my techniques for spotting these types of opportunities!