Gold. Everyone’s favorite hedge against doomsday.

Pandemic? Gold goes up.

Massive inflation? People run to gold.

Geopolitical tensions? There’s gold, waiting for peoples’ money.

Here’s the thing, though:

We just had (and still have) a pandemic and massive inflation. Meanwhile, Russian troops are massing along the Ukraine border, and China’s getting aggressive about Taiwan.

Yet…

Gold hasn’t shot to the moon. It’s doing alright, but not making anyone bags of cash.

So if you’re wondering where’s all the “wealth protection” money’s going to...

Look no further than the EV revolution for the answer:

A particular type of metal is needed for the battery in that Tesla…

And that would be lithium.

Lithium is one of the best metals for making these batteries.

But I won’t explain all the science. I’m just a trader and investor.

Let the experts, like battery company RELiON, explain:

“Lithium can charge and discharge at a high rate providing maximum versatility for all types of applications. Fast charging minimizes downtime, and lithium’s high rate of discharge is perfect for a burst of power.”

Of course, EVs play a vital role in global environmental goals, even if work needs to be done to make lithium mining and battery making more eco-friendly.

As BNB Paribas Asset Management puts it in a July 30, 2021 post on their Investor’s Corner blog:

“We believe lithium is the solution to decarbonising passenger transportation, but a lot can be done to make the supply chain more sustainable.”

That said, they’re optimistic on the eco-friendly front. They point out a few companies are already working on solutions to lower the lithium supply chain’s carbon footprint.

So the general popularity of EVs mixed with green energy goals means massive demand…

And the data shows that could be the case.

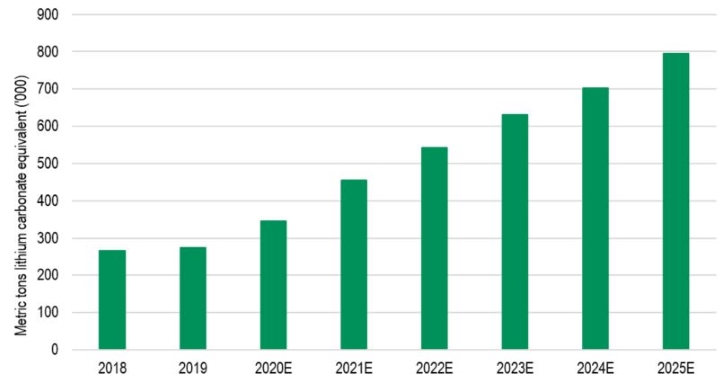

Here’s a demand projection from BNB Paribas’s blog Investor’s Corner:

Oh, and EVs aren’t the sole driver of lithium demand, either.

BNB Paribas notes:

“It should be noted that EVs are not the sole driver of demand. In 2020, they made up 39% of demand, but that is expected to rise to comfortably more than 60% by 2025. The remaining 42% comes from consumer electronics batteries, energy storage batteries and a variety of industrial processes.”

In short, demand could surge.

One problem (that’s good for lithium investors):

Lithium supply might not keep up with demand.

Global X’s research shows that lithium miners are in no rush to bring enough lithium to market to meet the coming demand:

“To miners, building out supply ahead of demand is costly, puts downward pressure on lithium prices, and transfers risk to the miners,” Global X said in a June 2020 article.

They continue, “Waiting for demand to build first and then adding supply, however, would likely increase the price of lithium, padding miners’ margins and transferring the risk to the OEMs.”

In conclusion, lithium is set up to be one of the most precious metals of the future.

But with all these lithium miners to choose from… you need to know how to pick those with the most explosive potential.

That’s what we do over at the Profit Flow Group. We look for hidden disruptions called Statistical Disruptive Flows (SDF) that signal HUGE bets from big-time players.

And we have a brand new lithium pick that just went out to my PFG members yesterday.

This one has 10x potential!

If you want to join us and learn how to gain access to the new trade:

Check out my free training on my SDF strategy and PFG here.

FYI:

Want to learn how to play Tesla?