Almost every single strategist repeats like a parrot, “We expect -15% to -20%.”

I don’t blame them… but still, this is just a sign of career management rather than professionals doing their homework.

Nah — I think we’re in a bull market… and some recent research (and experts) agree with me.

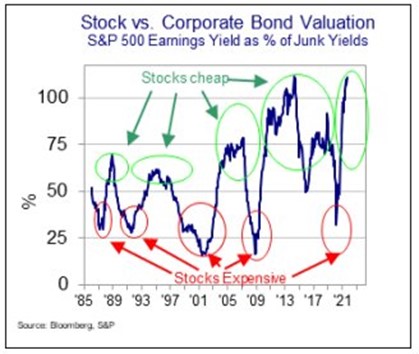

Here’s a fascinating chart from Brian Reynolds of Reynolds Strategy analyzing stock valuations (using the S&P 500) as a % of corporate/junk bond yields.

As Reynolds himself says:

“To get to fair value while holding bond yields at this current level, the S&P 500 would have to be over 9000. To get to fair value while holding stocks at this price would mean that junk yields would have to surge from the current 3.86% to over 8%.”

For reference, the S&P 500 is just under $4,500… aka just under HALF of what Reynolds claims it should be.

This logic is pervasive throughout Wall Street. Chris Grisanti of MAI Capital said:

“On an earnings yield basis, the market is at 4.8%, with the ten-year bond yield at 1.3%. That 3.5% difference would indicate the market is actually CHEAPER than usual in the current rate environment.”

And then you have Cathie Wood of Ark Invest:

"So many people ask me, 'Are we in a bubble?' We couldn't be further from it. I do not believe that the average investor understands how productive these next five to 15 years are going to be [for stocks] as these S-curves feed one another and enter exponential growth trajectories that we have never seen before."

Now, time to get real with you for a second to help you understand where I’m going with this.

When I was in my mid-20s, I suffered depression.

I feel this is fairly common among mid-20 somethings. You’re out on your own, figuring out what to do with your life — often without anyone to guide you...

But it is not the same for someone from the Caribbean.

In the Caribbean, Prozac is simply not a thing. People think you’re either crazy or weak for having depression or taking drugs for it.

Mental illness was not accepted like it is now, especially where I lived...

So I had to figure how to heal myself.

Well, I stumbled upon something called “Pranayama,” a yoga practice that focuses on breathing. That helped me manage and control my emotions and slowly climb my way out of the darkness.

But why do I tell you this?

Well, Benjamin Graham (of The Intelligent Investor fame) invented the metaphor of the market being a person — Mr. Market — in that book.

Mr. Market, too, can heal himself like I did.

Mr. Market will organically find how to heal himself without (potentially) running into a deep pullback... as many media outlets beg the universe to happen.

Companies are going to become more efficient. Just ask Microsoft, which just announced a massive buyback:

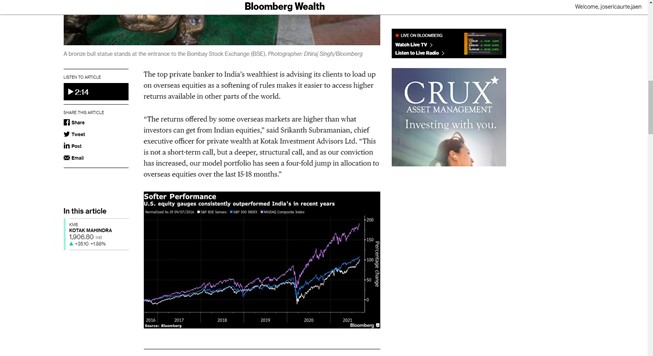

Alongside that, new players will enter the arena — whether it’s innovative millennials or international investors. Per Bloomberg:

That’s why I’m on the side of Brian Reynolds, Cathie Wood, and the other bulls.

So to tie it together: I’ve changed a lot since my mid-20s depression days. It was hard to see the better days ahead during the bad times, but I got there…

And similarly, everyone focuses on the dark and bad scenarios in the market and economy and cannot think of the boom times ahead.

I do… so I will keep building a plan to maximize those better days.

It is your turn to decide on which side you want to be. If you want to join me in taking advantage of this bull market…