One sector I’ve had my eye on is uranium. I’m pretty bullish on the industry, and some investors with a lot of capital seem to agree with me.

Case in point:

Cameco.

Cameco’s down today.

And yet, whales are loading up in the options market.

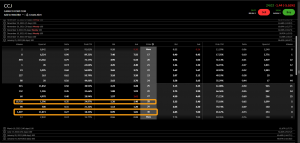

Someone bought over $1 million 28C Jan 21, 2022 options… for a total of 10,744 contracts.

Compare that to the previous open interest of 1,296!

Plus, looks like someone’s loading up on 30C at the same expiration, according to the image.

That can’t be an accident.

Here’s the thing: I agree with these whales. I’m bullish on Cameco…

And in my new video, I’ll show you why using technical analysis and price rotation targets.

Watch the video to see all the details.

By the way, it’s not just Cameco. I’m bullish on the uranium industry.

That’s why we have 2 uranium picks in our Profit Flow Group portfolio. They’re in the buy zone, but not for long.

To learn how I found these picks…