The world is caught between a rock and a hard place right now.

On one hand, people want green energy. They want to power society without harming the environment.

On the other hand, we have skyrocketing energy demand as the world opens up and people get back to business… but the current green energy situation isn’t proving to be enough.

You can see the results of this in the current energy shortage. Governments wanted to phase out “dirty” energy, and now there’s not enough to go around.

I (and some people in the markets) have a solution to this predicament:

Nuclear power!

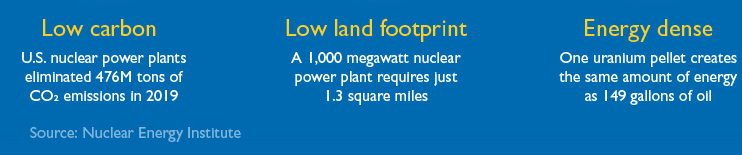

As I wrote a few weeks back, nuclear energy is super clean (fulfilling the green energy movement) and super efficient (fulfilling the general energy demand).

Proof from The Visual Capitalist:

It’s an obvious solution…

Which brings me to this:

The uranium market has seen a long decline over the past decade… but it might just swoop back in as a great long-term play.

Just take a look at Global X Uranium ETF (URA), which offers a good glimpse at the overall state of the uranium sector:

See? The bearish trend’s turning around.

Additionally, sites like Bloomberg and World Nuclear News have reported big investment funds are getting their hands on uranium.

We’re in the infancy of a healthy bullish leg…

Offering you the opportunity to capture MASSIVE potential profits if you get in early.

Now, if you want to go beyond a broad uranium ETF…

And amplify your potential returns with some low-risk, high-reward-potential options plays...

We have 2 uranium positions inside my Profit Flow Group community that are still “buys!”

Not for long, though.

If you want to maximize your profit potential in this ultra-clean and ultra-efficient energy market…

Click here to learn more about my strategies and PFG community today!